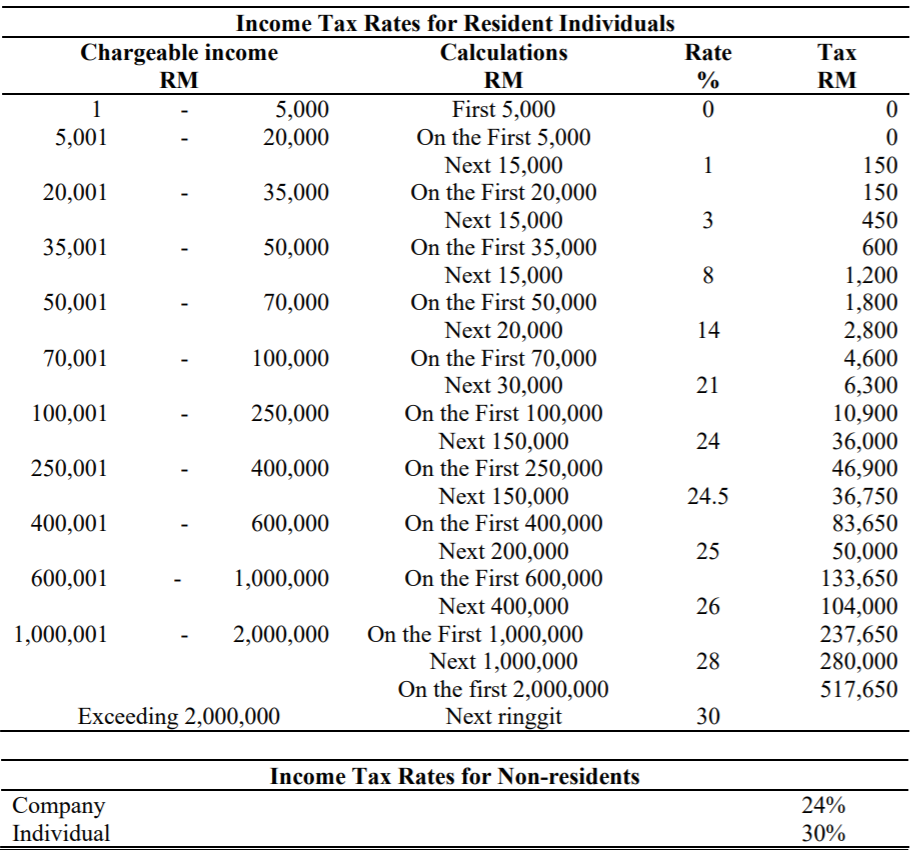

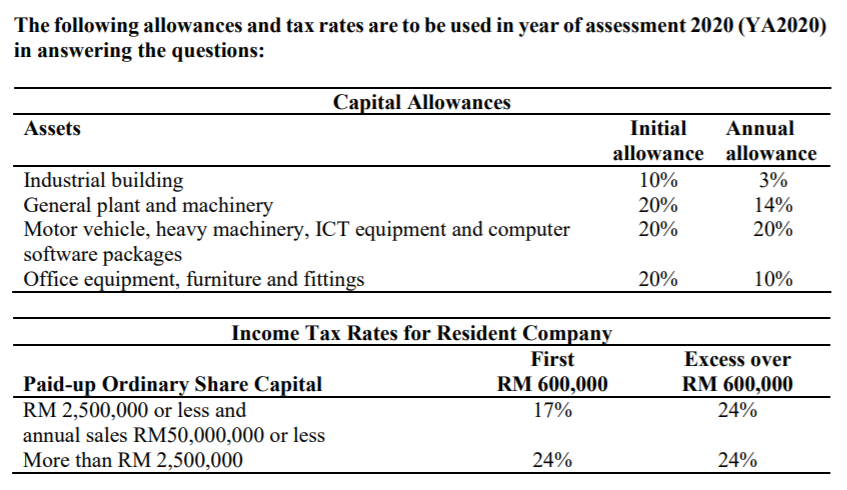

Tax rates and allowances are on pages 24. Finance questions and answers.

Taxable Income Formula Examples How To Calculate Taxable Income

Q2 Define a person under the Income Tax Act 1967.

. First question was whether credit cards are accepted. Question and Answer of Finance and Taxation PTPTN Loan Repayment. Do NOT open this paper until instructed by the supervisor.

To practice TX MYS exams in the CBE environment you can. During reading and planning time only the question paper may be annotated. Input Tax and Output.

May I pay less than. 100 Questions and Answers book tackles the practical administrative and operational questions of GST using a question-and-answer format. Two children are twins 13 years old and the last is 6 years old.

Capital Goods Adjust 12. Partnership Malaysian Taxation Question and Answer 18 Jan 2021. Malaysian Taxation Question 1 A.

Seribayu Enterprise is a. Dania a Malaysian resident is married with 3 children. Malaysia MYS To view PDFs of past exam papers for Malaysia please select from the list below.

Malaysian taxation question and answer nov 2019 question and answer part 1. Losses will be disallowed if both of the following. Ive took up a job in the Middle East as FIFO 5 weeks on 4 weeks off in a permanent office.

She is a bank manager HSBC. Question and Answer of Finance and Taxation. Payment made to Kiyoto Ltd As the technical services was performed in Malaysia it is classified as section 4A i class of income and would be subject to withholding tax under section 109B.

Seribayu Enterprise is a partnership business owned by Seri and Bayu engaged in supplying fresh flowers to customers. MALAYSIAN INCOME TAX LAW ANSWERS TO TUTORIAL QUESTIONS 2015 Week 2 - Q1 - 5 Question 1 a i Scope of charge sec 3 - Lays out the tax net for Malaysia-p. Malaysian taxation question and answer nov 2019 question and answer part 1.

Individual Bankruptcy Winding Up of Company INDIVIDUAL BANKRUPTCYWINDING UP OF COMPANY. MANAGING FINANCE AND TAXATION. Taxation TX Past exam library.

MALAYSIAN INCOME TAX LAWANSWERS TO TUTORIAL QUESTIONS 2015 Week 2 - Q1 - 5 Question 1 a i Scope of charge sec 3 - Lays out the tax net for Malaysia- p.

Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

Provision For Income Tax Definition Formula Calculation Examples

Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account Nri Saving And In Investment Tips Savings And Investment Savings Account

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

The Following Allowances And Tax Rates Are To Be Used Chegg Com

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Taxable Income Formula Examples How To Calculate Taxable Income

Provision For Income Tax Definition Formula Calculation Examples

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Mortgage Interest Tax Software

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

Taxable Income Formula Examples How To Calculate Taxable Income

Average American Remains Ok With Higher Taxes On Rich

Difference Between Resident And Nri Fixed Deposit India Nri Saving And Investment Tips Savings And Investment Investment Tips Investing

The Following Allowances And Tax Rates Are To Be Used Chegg Com

/taxes-word-on-wood-block-on-top-of-coins-stack-869670536-efbe1559282e4a5c87945445dd1b32a3.jpg)